31+ Home loan tax saving calculator

This calculator is compiled for Resident Individuals ie. Our home loan tax benefit calculator.

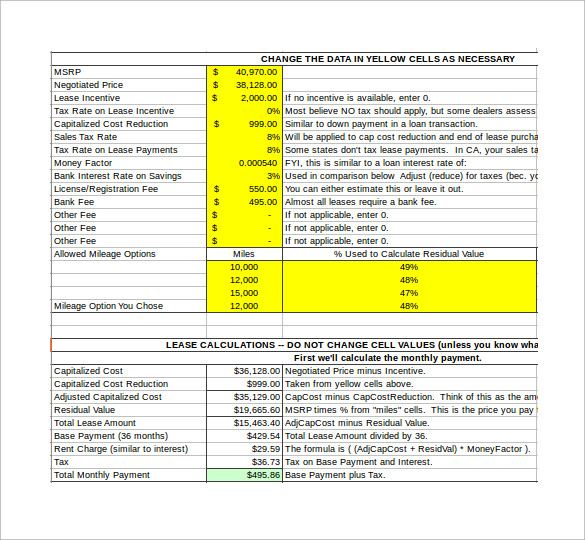

Free 9 Sample Lease Payment Calculator Templates In Excel

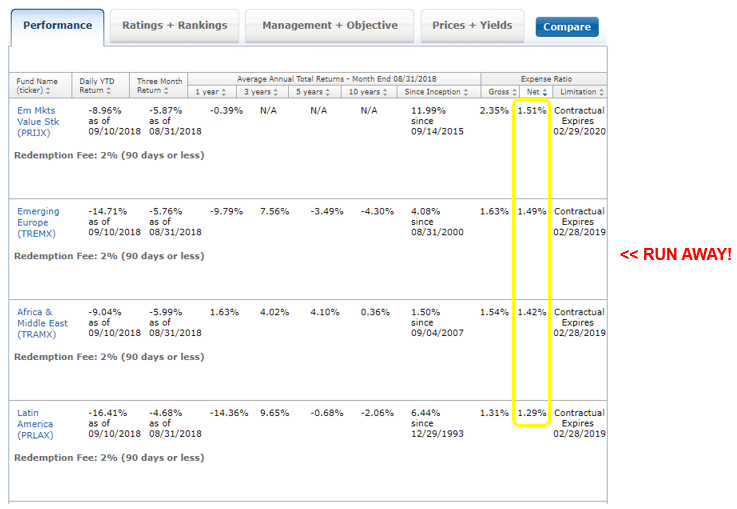

TATA Tax Saving Fund-ELSS.

. Regular or Senior citizen Then enter your gross annual. Registered Office 2nd floor DLF Centre Sansad Marg New Delhi - 110001. 6 Things Need to Know Before Getting a Fast Business Loan Whether its a business emergency or a fantastic opportunity in front of you you need access to capital now.

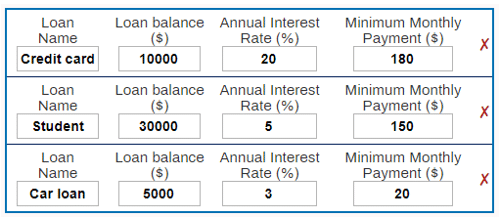

This tool estimates your average yearly tax savings on a mortgage loan and calculates your after-tax interest rate on the loan. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Financial Details Select Age In Years Yrs 18Yrs 80Yrs Total.

Being an automated tool the calculator weighs in all the elements to calculate the amount such as gross annual income home loan interest rate principal amount home loan EMIs existing. You can use the Home Loan Tax Saving Calculator on Bajaj MARKETS to calculate the total tax benefit that you can get on your home loan. An EMI calculator for a home loan can help you make an informed decision about buying a new house.

U65990DL2017PLC322041 IRDAI Registration Code for Corporate Agent. Residents below 60 years of age Sr. 150000 on the principal repayment of a home loan.

To know your benefits via a home loan tax saving calculator simply follow these 3 steps. For a line payment you can. First choose the applicable customer type.

The interest paid on a mortgage along with any points paid at. Under Section 24 you claim up to Rs. How is tax exemption on Home Loan.

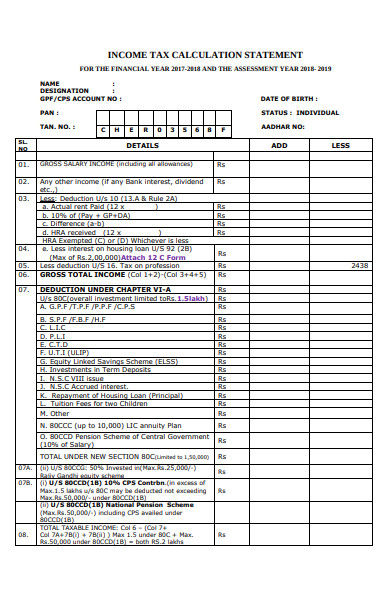

Under Section 80C of the Income Tax Act you can claim deductions of up to Rs. This calculator helps determine your tax savings on loans or credit lines with tax-deductible interest payments. Income Tax Payable Before Home Loan 862500.

Our calculator limits your interest deduction to the interest payment that would be paid on a 1000000 mortgage. Using the Home Loan Tax Saving calculator one can find out how much can be saved on home loan through tax deduction and income tax payable for the respective annual. For a loan payment select fixed term loan.

Home Loan EMI Calculator. Tax Saving Calculator Accurately calculate your final payable tax amount before and after tax deductions on your home loan. Total Income Tax Benefit 105000.

The calculator is simple and has an easy-to. Call 800-236-8866 Monday-Friday 9 am-5 pm. Income Tax Payable After Home Loan 757500.

Tax Saving Calculator AY 2021-22 2022-23 About this Calculator. Interest rate Annual interest rate for this mortgage. Tax Saving Calculator can be used to get an estimate of the tax that can be saved by claiming the deductions available as per the applicable laws.

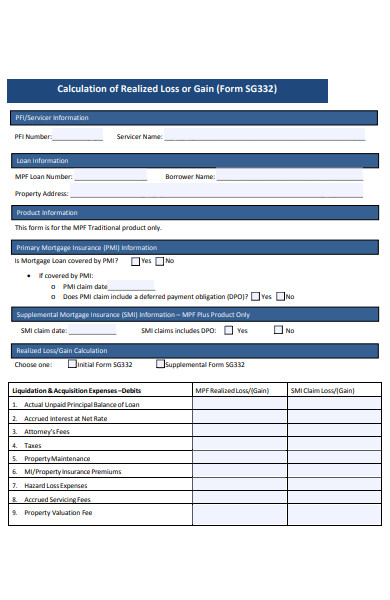

Free 31 Calculation Forms In Pdf Ms Word

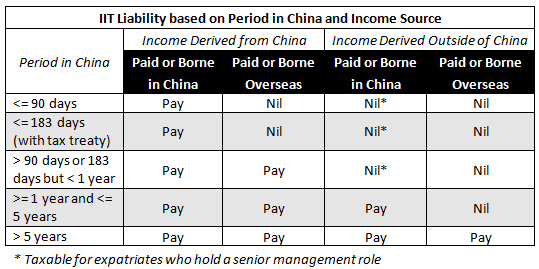

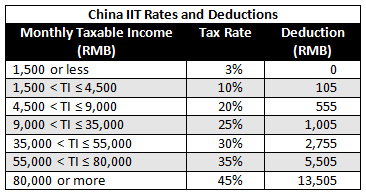

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

How To Save Money Fast 3 Tricks Above 1000 Hr

Free 31 Calculation Forms In Pdf Ms Word

Free 31 Calculation Forms In Pdf Ms Word

Img004 Jpg

G201504061231509392619 Jpg

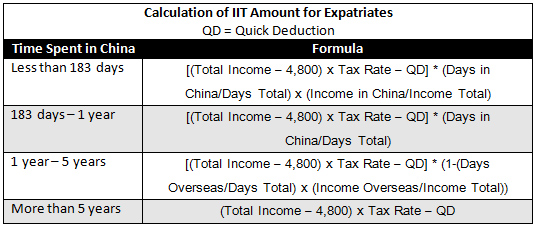

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

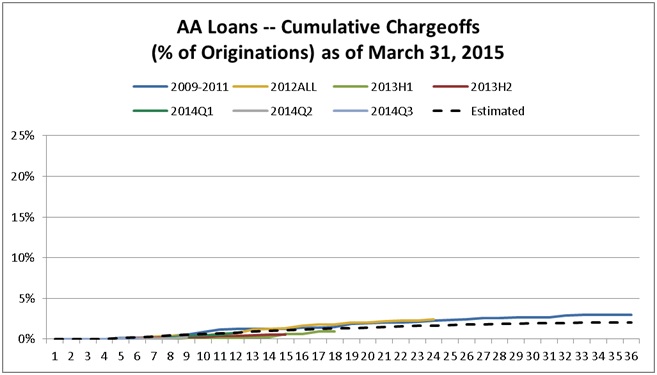

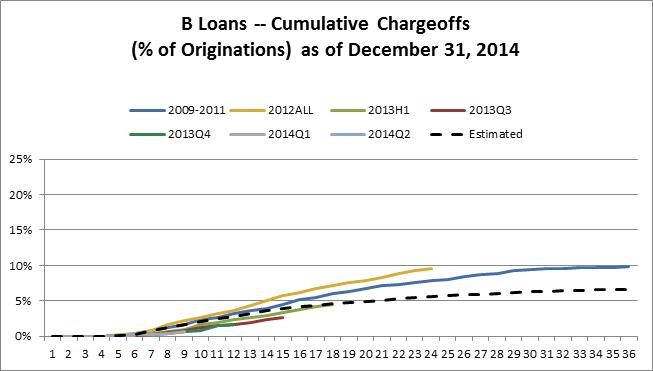

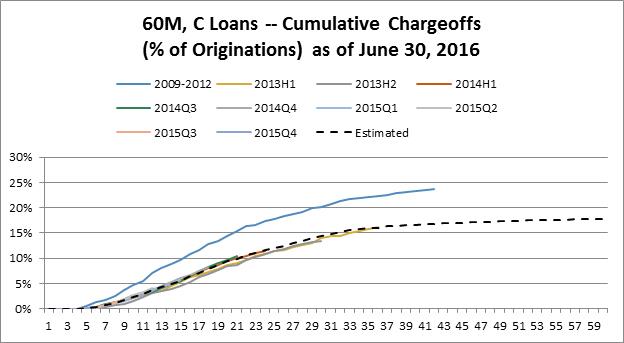

Prosper 424b3 20160630 Htm

The Measure Of A Plan

![]()

The Measure Of A Plan

How To Save Money Fast 3 Tricks Above 1000 Hr

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

How To Save Money Fast 3 Tricks Above 1000 Hr

Free 31 Calculation Forms In Pdf Ms Word

The Measure Of A Plan

China Expat Tax Filing And Declarations For 2012 Income China Briefing News